Introduction: The Role of B2B Sales Intelligence Platforms

When B2B sales teams want to effectively generate a sales pipeline, they need access to accurate, up-to-date and compliant information. But manual research, out-of-date contact lists and half-finished company overviews can kill their momentum and cut down the number of successful conversions.

Well-known B2B sales intelligence platforms have stepped in to sort out these problems, pooling contact data, company information and buying signals into one neat system. Among the most popular of these tools are Cognism, ZoomInfo and others. These platforms help sales teams blast out targeted messages, account-based marketing campaigns and revenue-boosting initiatives by zeroing in on people who are most likely to buy.

As the demand for sales intelligence tools is on the rise, picking the right one is becoming increasingly important, and depends on the accuracy of the data, the areas the tool covers, its compliance standards, number of integrations and price. Coming racing into this market, this article takes a good hard look at what Cognism brings to the party, and how it stacks up against the competition, starting with a fair-minded rundown of what the platform does.

What Is Cognism?

Cognism is a B2B sales intelligence and data platform that offers go-to-market teams enriched company and contact data to target, and engage with their prospects. The platform is used mainly by sales, marketing, and revenue operations teams to power outbound prospecting, account-based marketing, and pipeline generation.

Essentially, Cognism offers a repository of business contacts and companies, together with some context (firmographic, technographic and intent data). The product fits into the sales intelligence category, alongside similar solutions such as ZoomInfo, Apollo and Lusha — which all have varying levels of strength in terms of data coverage, international presence, and feature set.

One of Cognism’s differentiating factors is its focus on data compliance and privacy — particularly in the EU and UK where data protection laws are most stringent. This focus permeates every aspect of how data is sourced, cleansed and served up to users.

The platform tends to serve mid-market and enterprise customers that operate structured outbound sales motions, and require integration with CRM and sales engagement platforms. Cognism is therefore deployed as one element of a sales tech stack, often for use-cases such as prospect research, list building and data enrichment.

Core Capabilities of Cognism

Cognism positions itself as a B2B sales intelligence platform designed to support outbound prospecting, account-based strategies, and data-driven sales workflows. Its core capabilities focus on providing contact data, company insights, and buying signals while maintaining compliance with data privacy regulations.

1. B2B Contact & Company Data

Ultimately, Cognism offers B2B contact and company data for prospecting and account research. Their datasets usually encompass:

- Business email addresses.

- Direct dial and mobile phone numbers.

- Company firmographics such as industry, company size, and location.

Their solution is unique in that they focus on having a high number of mobile phone numbers available. This can be very useful for sales teams that are focused on calling. Their coverage is stronger in some geographies, particularly the UK and Europe, but they do cover globally.

As is the case with most sales intelligence platforms, not every field will be filled out for every record depending on the role, location, and industry.

2. Intent Data and Buying Signals

Cognism's use of intent data is basically the key to finding people who are in the process of researching or showing a genuine interest in their products or services, when companies are looking to reach new customers.

Intent signals are commonly used to decide where to send outgoing sales outreach, align sales and marketing efforts, and underpin account-based marketing plans. This information does not predict that a purchase will be made, but gives a team a better idea of what topics, solutions, or people to focus on, if combined with firmographic and behavioral data.

3. Firmographic and Technographic Insights

Regarding targeting and segmentation, Cognism has got you covered with its firmographic and technographic data, which can be broken down to company growth indicators, revenue or employee-based segmentation, and insights into a company's technology stack. This type of data is usually employed by the sales operations and marketing teams to nail down their ideal customer profiles (ICPs) and make their marketing campaigns more effective.

4. Data Compliance and Privacy Controls

One of Cognism’s distinguishing aspects is its emphasis on data compliance, particularly with GDPR and other data protection frameworks. Compliance-related features are intended to help organizations:

- Reduce regulatory risk

- Maintain responsible outreach practices

- Operate more confidently in EU and UK markets

For companies operating in regulated regions, this focus can influence tool selection as much as data volume or feature breadth.

5. CRM and Sales Tool Integrations

When using Cognism, teams can effortlessly sync their data with CRM and sales engagement platforms, essentially streamlining their workflows. For full CRM support and outreach automation, explore the best CRM solution for sales and outreach teams.

Coming from the goal of eliminating the hassle of manual data entry, these integrations are also intended to improve the consistency of pipeline management, however the success of this ultimately depends on how well the team’s processes are aligned and how clean their CRM is.

Data Accuracy & Reliability

Data accuracy is king and a tiny mistake in a contact's job title or inactive phone number can send your sales efforts into a tailspin, when evaluating a B2B sales intelligence platform.

Coming from a position of putting the accuracy of its contact information front and centre, Cognism claims that its platform zeroes in on the freshest and most accurate contact-level information, specifically mobile numbers and business emails. Since most sales intelligence tools of this nature also use a combination of automated and human-verified processes to populate, enrich and update their data, Cognism’s approach is no different, and with the aim of drastically reducing the number of bounce-backs and boosting connection rates for the people working with its data.

That said, it is important to note that no B2B data provider can guarantee complete accuracy at all times. Company structures change, professionals switch roles, and contact details become obsolete frequently—especially in fast-moving industries. Users may still encounter:

- Missing or outdated contact details for niche roles

- Variations in data depth across regions or industries

- Differences in accuracy between enterprise accounts and SMBs

From a reliability standpoint, Cognism’s emphasis on compliance-driven data collection can influence both the availability and structure of its dataset. While this may limit certain types of data compared to less restrictive sources, it also reduces regulatory risk for teams operating in regions with strict data protection laws.

In practice, data accuracy on platforms like Cognism is best evaluated not in isolation, but in how well it supports:

- Consistent outbound activity

- CRM enrichment and hygiene

- Lead prioritization alongside intent or firmographic signals

For most teams, the effectiveness of the data ultimately depends on how it is integrated into their sales workflow and how frequently records are refreshed or validated internally.

User Experience & Platform Usability

User experience plays an important role in how effectively a sales intelligence platform is adopted across teams. Beyond data quality, factors such as interface design, learning curve, and day-to-day usability can directly influence productivity and ROI.

1. Interface & Navigation

Cognism is designed as a web-based platform with a structured dashboard that allows users to search for contacts, companies, and accounts using multiple filters. The interface generally follows a modern SaaS layout, making it familiar for users who have worked with CRM or sales engagement tools before.

Key usability aspects include:

- Clear separation between company-level and contact-level data

- Advanced filtering options without overwhelming the screen

- Logical workflows for exporting leads or syncing data to CRM systems

For most sales and SDR teams, basic prospecting tasks can be performed without extensive training, although advanced features may require some onboarding.

2. Learning Curve & Onboarding

The learning curve with Cognism is moderate rather than instant. While core features such as searching contacts or exporting lists are straightforward, deeper capabilities—such as intent data usage or complex filtering—benefit from guided onboarding.

Typical onboarding elements include:

- Product walkthroughs

- Training sessions for teams

- Documentation and help resources

Organizations with dedicated RevOps or sales enablement support tend to adopt the platform more efficiently compared to very small or non-technical teams.

3. Team Adoption & Daily Use

Cognism is primarily built for structured sales workflows rather than casual or ad-hoc usage. It fits best into environments where:

- SDRs or BDRs work with defined outbound processes

- Data is regularly synced with CRM systems

- Prospecting is done at scale

For individual users or teams without a defined outbound strategy, the platform may feel more complex than necessary. However, for teams operating at volume, the usability aligns well with repeatable sales processes.

4. Integrations & Workflow Impact

From a usability perspective, integrations play a major role. Cognism’s ability to connect with CRM and sales engagement tools helps reduce manual data entry and context switching. When properly configured, users can move from prospecting to outreach with minimal friction.

That said, the quality of the experience often depends on:

- Correct initial setup

- CRM data hygiene

- Team familiarity with integrated tools

Overall Usability Assessment

Overall, Cognism offers a user experience that prioritizes structured prospecting and operational consistency over simplicity. While it may not be the lightest tool to learn, it is designed to support teams that rely on repeatable, data-driven sales workflows rather than one-off research. To get maximum ROI from sales intelligence platforms like Cognism, teams should align prospecting and outreach efforts with proven B2B SaaS marketing strategies that support scalable and compliant growth.

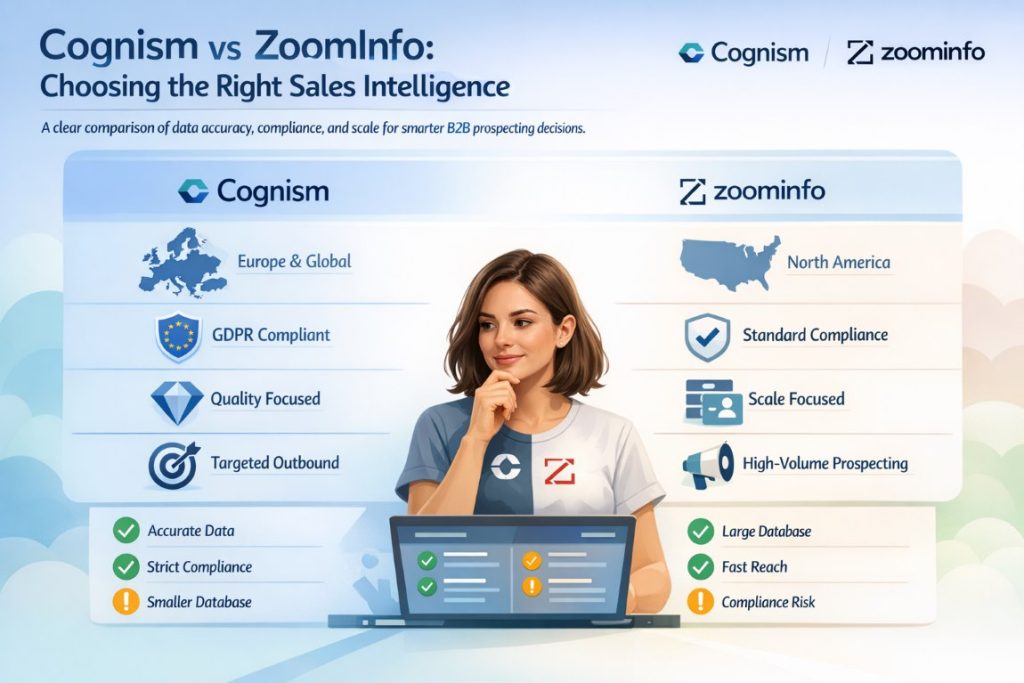

Cognism vs ZoomInfo: A Quick, Practical Comparison

Cognism and ZoomInfo are often evaluated together because both serve the same core purpose: helping B2B teams identify and reach the right prospects. However, their strengths differ slightly depending on region, compliance needs, and sales strategy.

At-a-Glance Comparison

| Aspect | Cognism | ZoomInfo |

| Primary Market Strength | Europe & global markets | North America |

| Compliance Focus | Strong GDPR-first positioning | Compliance supported, less emphasized |

| Contact Data Type | Emphasis on verified mobile numbers | Broad database with deep coverage |

| Data Scale | Quality-focused | Scale-focused |

| Typical Use Case | Targeted outbound, compliance-sensitive teams | Large-volume prospecting, enterprise sales |

Where Cognism Tends to Stand Out

Pros

- Strong emphasis on data compliance, especially for EU outreach

- Reliable mobile number coverage for direct sales engagement

- Well-suited for teams prioritizing data accuracy over sheer volume

Cons

- Smaller overall database compared to ZoomInfo

- Pricing may be less accessible for very small teams

- Coverage can vary by niche industry or region

Where ZoomInfo Tends to Stand Out

Pros

- Very large and deep B2B contact database

- Strong presence in the US market

- Extensive integrations and enrichment capabilities

Cons

- Can provide high data volume, requiring filtering and cleanup

- Compliance considerations may require additional internal checks for EU-focused teams

- Often positioned at a higher price point for full feature access

How Teams Typically Choose

- Cognism is often preferred by teams selling into Europe or multiple regions, especially where compliance and phone accuracy matter.

- ZoomInfo is commonly chosen by US-focused or enterprise teams that need large-scale data coverage for high-volume prospecting.

Rather than being direct substitutes, the tools are frequently evaluated based on market focus, compliance requirements, and outbound strategy maturity.

Final Assessment

When it comes to B2B sales intelligence, Cognism presents itself as a robust and highly regarded platform for teams prioritizing data compliance, global coverage and outsized returns in their outbound efforts, and rightly so, thanks to its commitment to GDPR-safe data and verified contact information that’s particularly valuable to companies operating in the UK, Europe and worldwide.

However, much like every high-end sales intelligence tool, Cognism isn’t a catch-all solution.

It really depends on the maturity, budget and regional focus of the sales team. If companies are operating at an international scale or are predominantly North America centric, other platforms like ZoomInfo may sometimes be more aligned.

Cognism is at its most effective when used as part of a formal sales or Revenue Operations strategy.

.png)

.png)

.png)